Deciding between a Gold IRA can be a daunting task for investors. Both offer benefits, but their approaches differ significantly. A tax-advantaged plan allows you to invest in gold bullion within a retirement savings account, while physical gold provides immediate control. Consider your investment goals carefully. Do you value tax benefits and portfolio diversification, a Gold IRA may be the suitable option. However, if you seek tangible investments, physical gold could be more attractive to your needs.

- Explore different providers offering both types of strategies.

- Analyze fees, minimum investments, and past results carefully.

- Seek advice from a qualified financial advisor to make an well-considered choice tailored to your individual goals.

A Comparison of Gold IRAs and 401(ks) for Retirement

Planning for retirement can feel overwhelming, with numerous investment options vying for your attention. Two popular choices often considered are Precious Metal IRAs and traditional Retirement Savings Plans. Each offers distinct advantages and disadvantages, making it crucial to understand their nuances before making a decision. A Physical Gold IRA allows you to allocate a portion of your retirement funds to physical gold, potentially safeguarding against inflation and market volatility. Conversely, a 401(k) typically invests in a diversified portfolio of stocks, bonds, and other assets, offering broader market exposure but potential for greater risk.

- Gold IRAs often come with higher initial costs compared to traditional Employer-Sponsored Retirement Funds.

- Retirement Savings Plans often provide company-funded incentives, effectively boosting your retirement savings.

- Investing in a Gold IRA can potentially provide a hedge against inflation, while a 401(k) focuses on long-term growth through market participation.

Consult with a financial advisor to determine the best investment strategy that aligns with your individual needs and risk tolerance.

Unlocking Your Future: Pros and Cons of a Gold IRA

A Gold IRA, or Individual Retirement Account, presents an attractive avenue for diversifying your retirement savings. By investing in physical gold, you can potentially hedge against inflation and economic uncertainty. The allure of Gold IRAs is undeniable, but it's crucial to thoroughly weigh both the benefits and drawbacks before making a commitment.

- Begining with, Gold IRAs offer potential security against inflation, as gold has historically maintained its value during periods of economic uncertainty.

- Additionally, investing in gold can spread your retirement portfolio, potentially reducing overall risk.

- However, Gold IRAs often come with higher maintenance costs compared to traditional IRAs.

- Moreover, gold prices can be fluctuating, leading to potential losses in your portfolio value.

Ultimately, the decision of whether a Gold IRA is right for you depends on your unique circumstances, risk tolerance, and investment goals. Consulting with a qualified financial advisor can offer invaluable guidance in making Gold IRA fees an informed selection.

Top-Rated Gold IRAs: Find the Perfect Investment for Your Portfolio

Planning for a secure future? IRA Investments in Gold offer a compelling way to diversify your portfolio and potentially preserve wealth. Choosing the right firm is crucial to ensure you get the best rates and top-notch guidance.

- Meticulously examine your investment objectives before making a decision.

- Compare different companies and their pricing models.

- Look for trustworthy institutions with a history of successful track record.

With the right Gold IRA, you can potentially build lasting wealth. Start your research today and explore the opportunities of this valuable tool.

Unveiling the Gold IRA Landscape: What to Consider Before Investing

Embarking on a journey into gold Retirement Accounts? It's a wise move, offering a protection against market volatility. However, before you dive in, there are crucial factors to consider.

- Research reputable companies specializing in gold IRAs. Look for trustworthy track records and clear fee structures.

- Comprehend the nuances of storing your assets with a reputable custodian. Ensure they offer secure, insured locations.

- Spread your portfolio strategically. While gold can serve as a valuable component, don't dismiss other investment choices for a well-rounded approach.

Seek advice from a qualified financial advisor. They can deliver personalized suggestions based on your individual objectives. Remember, investing in a gold IRA is a long-term decision, and careful planning is key to achieving your objectives.

Is a Gold IRA Right for You?

A Gold Individual Retirement Account (IRA) can be a compelling investment option, offering potential benefits such as portfolio diversification and inflationprotection. However, before you venture into this type of IRA, it's crucial to understand both the possible rewards and challenges.

A Gold IRA allows you to invest a portion of your retirement savings in physical gold. This can potentially help mitigate the effect of market volatility on your overall portfolio. Gold has historically been viewed as a safe-haven asset, meaning its value may rise during periods of economic uncertainty.

Nevertheless, there are several key considerations to keep in mind. Gold IRAs typically have greater fees than traditional IRAs, and the value of gold can be volatile. Additionally, you'll need to research reputable dealers and custodians to ensure your investments are secure.

Ultimately, the determination of whether a Gold IRA is right for you depends on your individual financial goals, risk tolerance, and investment strategy. It's always best to discuss a qualified financial advisor to determine if this type of IRA aligns with your overall retirement planning objectives.

Mike Vitar Then & Now!

Mike Vitar Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Christy Canyon Then & Now!

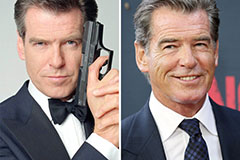

Christy Canyon Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!